Part 3 of 3: What about my Retirement Accounts?

Most people know that saving for retirement is essential, and tax-deferred accounts like 401(k)s, 403(b)s, and IRAs are among the most popular tools for doing so. These accounts offer a double benefit: a tax deduction on your contributions and tax-deferred growth until you tap into them during retirement.

However, for some retirees, these accounts come with a new challenge—Required Minimum Distributions (RMDs).

What's an RMD?

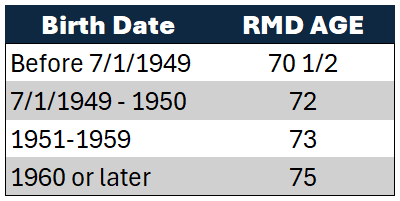

After years of letting you defer taxes on your retirement accounts, Uncle Sam & Co. eventually comes to collect. Once you reach a certain age (see chart below), you’re required to take a minimum withdrawal from your tax-deferred accounts, which counts as taxable income. The amount is based on your age and the account balance. While you can use the money however you like, you’ll be taxed on it whether you need the funds or not.

For retirees fortunate enough not to need to take these RMDs for their income needs, they can feel like an unnecessary tax hit.

The Answer: Qualified Charitable Contributions (QCD’s)

While the IRS isn’t usually known for its generosity, they do allow a way to avoid taxes on your RMDs. If you give your RMD directly to a qualifying charitable organization, you can avoid the taxes on the RMD amount. The best part? Even if your RMDs don’t begin until age 73, you can still start making QCDs at age 70 ½.

Why not just take the distribution personally and then donate the money?

On the surface, you’d think it’s the same net tax treatment; each dollar you take is taxable, the charitable contribution is tax deductible, and they offset for a net zero taxable event. There are two main reasons this strategy isn’t as efficient as utilizing a QCD.

- You might not be itemizing- Remember in part 1 of this series where we discussed itemized vs standard deductions? If you end up taking the standard deduction, you’re not getting an additional deduction for the charitable contribution. However, the IRA distribution is still taxed as income.

- It still kind of counts as income- Without getting too deep into tax talk, these charitable deductions don’t reduce your AGI (Adjusted Gross Income, or income before tax deductions) the way QCDs would. AGI is used in other calculations related to eligibility for tax credits, deductions, and Medicare premium adjustments. Since QCDs never hit the tax return radar and aren’t counted in AGI, they are the more tax-efficient option. Talk to your tax professional to see how this might affect your personal tax situation.

What about my 401k & Roth accounts?

401k- The RMD rules and ages apply to your 401k assets. Unfortunately, you can’t make a QCD directly from a 401k under current regulations. The workaround is to transfer your 401k to an IRA. There are several other factors to consider before making that decision that you should discuss with a financial professional.

Roth Accounts- Your Roth accounts do not have RMDs. Technically, you could do a QCD from your Roth, but since Roth distributions are generally tax-free, it doesn’t make much sense to use Roth funds for charitable giving when you likely have other options available.

Thank you!

I hope you found this series helpful and that it gave you a few ideas to explore further. We’ve only scratched the surface of this topic, and the real magic lies in blending these strategies to fit your unique situation. Connect with your tax and financial professionals to develop a personalized strategy to maximize the benefits to you, your family, and the charities you support.

Content in this material is for general information only and is not intended to provide specific advice or recommendations for any individual. All investing involves risk including loss of principal. No strategy assures success or protects against loss. This is a hypothetical example and is not representative of any specific investment. Your results may vary. This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.