Part 2 of 3: Maximizing the Benefit

In Part 1 of this series, we established what it means to be charitably inclined, standard vs itemized deductions, and Bunching. The second part of this series will focus on how to make sure you’re maximizing the amount your charity receives and getting the maximum tax benefit. Several potential strategies include trusts, but for this article, we will keep the scope to strategies that don’t involve trusts and giving during your lifetime.

Donating Highly Appreciated Assets

"You need to stop giving cash to charities.”

We’ve shared this with clients, and while it’s surprising at first, it makes sense when explained. This comes up when someone has non-retirement investments with significant gains and they’re donating enough to make these strategies worthwhile. There’s no specific rule on what “donating enough” is, this generally applies when charitable giving is in the thousands rather than small, occasional donations.

Many non-profit organizations can accept in-kind donations of stocks, bonds, mutual funds, or other liquid investments. Donating in-kind allows the donor to avoid capital gains, and the non-profit can sell the investment without incurring capital gains either (assuming it qualifies as a 501c3 organization). It’s important to coordinate with your tax professional, as there are limits on how much of the donation is deductible.

Let’s pretend you bought a stock for $1,000 that’s now worth $4,000, and you want to use the stock to make a charitable donation.

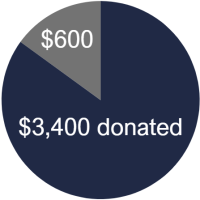

Scenario 1: Sell the stock and give the cash to a qualifying charity

- Sell the stock for $4,000 resulting in $3,000 long-term gains.

- $600 is paid in capital gains taxes

- The charity receives $3,400

- You get a $3,400 potential* tax deduction

Scenario 2: Donate the stock in-kind to a qualifying charity

- $4,000 of stock is transferred in-kind to the charity

- No capital gains taxes are paid by either party

- The charity receives $4,000

- You get a $4,000 potential* tax deduction

In the second scenario, the charity receives more, you get a higher tax deduction, and nobody pays any capital gains taxes. It’s pretty powerful stuff!

*Don’t forget about the standard vs itemized deduction topic covered in part 1!

Donor Advised Funds

If you’ve stuck with me this far, you’ll see how adding a Donor-Advised Fund (DAF) to your strategy can be a game changer, especially when you apply some of the concepts we’ve previously discussed.

What’s a Donor Advised Fund?

Donor

This is you, the person contributing.

DAF Sponsor

An organization that manages and administers the DAF account.

Grant Request

The Donor requests the DAF Sponsor to release funds to a particular charity.

The technical definition of a Donor Advised Fund (DAF) is a 501c3 organization that administers an investment account in the Donor’s name. A Donor makes an irrevocable donation to this account, receiving a tax deduction for that year. Contributions are usually stocks, bonds, mutual funds, cash, or other investments held in a separate account controlled by a DAF Sponsor (like Vanguard, Schwab, Fidelity, & American Endowment Foundation). The donor gets a tax deduction for the year the DAF account receives the funds. The funds can continue to stay invested, and the Donor can make Grant Requests for that year or future years. It’s important to understand that there’s no tax deduction in the year of the Grant Request since the deduction already happened when the funds were put into the account.

Why use a DAF?

I’d summarize it in one word: Control

A DAF allows you to control the year you take charitable tax deductions to coincide with the years you have a higher tax liability and need the deductions the most. Maybe it’s from a large bonus at work, selling a business, or some other sizeable taxable event.

It also allows you to control what charity you give to and when the charity receives the donation. One knock against Bunching is you might go 3-5 years without giving to a charity. Often, people have a deep connection with the charitable organizations they choose, so having a multi-year gap between donations just doesn’t sit right with them. A DAF is a great solution to this problem.

You also retain control of how the funds are invested until they’re distributed to the charity. The growth of the investments isn’t taxable and can be distributed to charities in the future.

Another added benefit is that the DAF can accept highly appreciated asset contributions. The rules work the same as those outlined earlier in this article.

Meet John & Jane Smith

John and Jane Smith are charitably inclined and like to give to several charities each year. Over the years, they’ve added and removed charities from their list. Typically, they give about $20,000 a year to these charities.

Jane is a business owner who sold her business this year for a price she never imagined she’d get. They now plan on retiring and want to start checking off their bucket list and spending more time with their kids and grandkids.

The Problem

The bad news is they now have a hefty tax liability on the sale of the business. Their tax professional tells them it’s a $500,000 capital gain on which they’ll owe $100,000 in taxes. Initially, the tax professional recommends a one-time contribution to their favorite charity of $200,000 as a bunching strategy. John & Jane are uncomfortable giving that much to a charity all in the same year. They feel like it’s too much and prefer the idea of giving to charities on a regular basis like they have in the past.

The Solution

- Their tax professional and financial advisor consult on their plan and recommend using a DAF to bunch their charitable donations into the year of the business sale.

- They identify $200,000 of highly appreciated stock in John & Jane’s non-retirement investment account to fund their DAF. The stock has $80,000 of unrealized capital gains.

- They contribute $200,000 and get the full deduction. This saves them $40,000 in taxes and avoids triggering the $80,000 in unrealized capital gains in their stock.

- For the next 10 years, Jane and John continue to give $20,000 each year to the charities of their choice and on their terms. An added bonus is that their DAF account grew by another $40,000 during that time, and they were able to extend their $20,000 giving for two more years.

Donor Advised Funds can be a great addition to anyone’s charitable giving strategy. It’s a relatively simple and cost-effective way to compound the benefits of charitable giving for you and the charities you support. Stay tuned for part 3, where we’ll dive into even more charitable giving strategies. As always, if you’re considering a Donor-Advised Fund or want more information, please schedule a conversation with a North Point Advisor to see how it could fit into your financial plan.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. Hypothetical examples are not representative of any specific situation. Your results will vary.