Part 1 of 3: Laying the Groundwork

Imagine a way to support your favorite charities while also cutting your tax bill. Sounds perfect, right? This is the excitement we see from clients when we introduce them to smart charitable giving strategies. But before diving in, it’s crucial to understand two essential concepts of tax-efficient charitable giving.

Part 1 of this series lays the foundation for understanding charitable giving and taxes. In parts 2 and 3, we’ll dive into specific strategies. I strongly encourage you to grasp the questions and steps outlined in this article before exploring the detailed strategies in parts 2 and 3.

Are you charitably inclined?

This question is step one for anyone considering a charitable giving strategy. This isn’t a question about your generosity or kindness, but rather your financial ability to have discretionary assets and the decision to give a portion of that discretionary surplus to a charity. Typically, this is determined after putting together a solid financial plan and identifying charitable giving as a goal. An easier way to decide if you’re charitably inclined is to answer the question below:

If you had a dollar and were presented with the two options below, which would you choose?

Option A: Pay 40 cents in taxes and keep 60 cents for yourself.

Option B: Give the full dollar to a charity and keep nothing for yourself.

If you answered Option B above, then you have some level of charitable inclination. I start with this question because it’s common to think there’s a way to both give to a charity AND put more after-tax dollars into their pocket. That’s simply not the case. Giving to charity is a selfless act.

Are you actually getting a tax deduction?

The second step is to make sure that you’re being as tax-efficient as possible with your charitable giving. There can be a big difference between the standard tax deduction and itemizing deductions, but I often hear people say “I get a tax deduction for that” when referring to charitable giving, mortgage interest, real estate taxes, or any of the other potential deductions. While reviewing their tax return, we often discover that this wasn’t the case, and they didn’t get any additional tax deductions for their donations.

Individual taxpayers can choose between taking the standard deduction or itemizing their deductions on their tax return, selecting whichever option provides the larger deduction. When you take the standard deduction, the deduction amount remains the same regardless of your charitable contributions.

One solution to this is bunching multiple years of your planned charitable giving into a single year. Below is a simple example of a person who gives $10,000 to charity every year and has another $14,000 of expenses eligible for itemized deductions.

Consistent Charitable Giving:

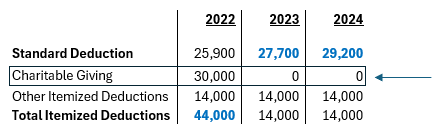

Over these 3 years, this individual took the standard deduction each year based on it being higher than the total itemized deductions. This totals $82,800 in total deductions. Now let’s assume they bunched their charitable giving into the first year:

Bunching Charitable Giving:

Over the same 3 years and the same total charitable giving, the individual was able to deduct $100,900. That’s a $18,100 increase in deductions. If we assume they’d pay taxes at a 40% rate, that’s a tax savings of over $7,000!

Now that you’re familiar with some key concepts in tax-efficient charitable giving, you’re ready to explore specific strategies. Join us in parts 2 and 3 of this series to dive deeper into effective methods for maximizing your charitable contributions and their tax benefits.

Content in this material is for general information only and is not intended to provide specific advice or recommendations for any individual. All investing involves risk including loss of principal. No strategy assures success or protects against loss. This is a hypothetical example and is not representative of any specific investment. Your results may vary. This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.