Most investors, including professionals, woefully underperform the indexes. This is because humans are hard-wired to make the same costly mistakes repeatedly. Ironically, attempts to “beat the market” sabotage long-term results. The errors are not due to analytical or quantitative miscues, but instead are emotional. Fortunately, there are ways to not only avoid these pitfalls but also use them to your advantage.

Avoid Costly Mistakes

In the National Football League, a team that has three turnovers in a game has a greater than 80% chance of losing. It’s not so much what a team does to win, but more about what they don’t do. A team that is average in all aspects but is superior at holding on to the ball will have a very successful season. A team that holds on to the ball and is good at taking it away will be championship caliber.

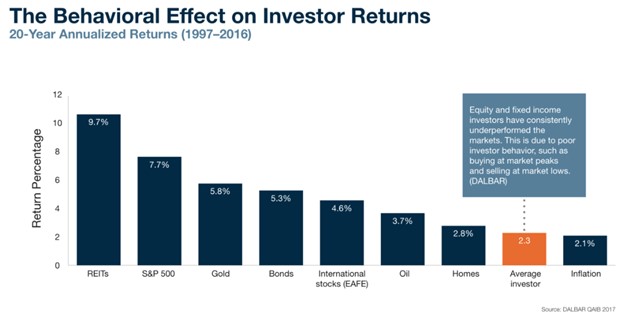

In investing, the “turnovers” can largely be attributed to two emotions – fear and greed. These emotions seem strongest when the market is volatile or at extremes, both to the upside and downside. The chart below highlights the damage caused by these emotions. During the 20 years of the study, the average investor barely kept up with inflation. Over time, these results are disastrous to financial plans.

The most common and damaging mistakes include…

- Chasing the hot stock, fund, or market – Whether it’s fear of missing out or getting greedy about returns, everyone wants to own the stocks being bragged about in the news. It’s comfortable owning something that everyone agrees with. Comfort, however, comes at a high cost in investing. On the way to gaining popularity, investments generally become expensive, resulting in lower long-term returns. Changes in market sentiment can exacerbate this quickly. So, the question is, do you want short-term comfort from buying expensive stocks or long-term comfort from buying stocks that will generate attractive returns?

- Liquidating investments when the market is down substantially – The stock market is the one place where people don’t enjoy buying items that are on sale. It takes confidence and fortitude to buy when the news is bad, but remember when you buy equities, you are really buying the future stream of earnings. The lower the price you pay for that stream, the higher your eventual return. Inverse to example 1, going from poor to fair conditions can create a powerful tailwind for stock prices. Don’t let fear drive you out of the market when the opportunities are best.

- Choosing the wrong definition of success – What is your goal? Do you want to beat a benchmark or fund retirement? Prudent portfolio management is about providing the highest probability of reaching your goal, and if that goal is retirement, your portfolio should not be centered around obtaining the highest possible return. Attempting to beat a benchmark any given year can lead to excessive risk-taking and emotional whipsaws, meanwhile, that arbitrary benchmark might not even be best for your situation. Typically, the best strategy is to have an allocation that you can stick within any environment and that meets your long-term projected needs. Keep your focus on the long-term plan, not short-term performance. This plan should also address liquidity reserves. It is much harder to stick to a plan when you are forced to take distributions during a lengthy bear market.

“Be fearful when others are greedy and greedy when others are fearful.”

- Warren Buffett

How to Excel at Investing

Here is one idea – Invest in a basket of index funds and periodically rebalance to your long-term target allocations. Rebalancing will force you to buy in down markets to prevent emotional selling, and it will force you to sell equities in strong markets. This simple strategy, while not perfect, will outperform most investors. This then begs the question, “If I do this, why do I need an advisor?”

If you can answer “yes” to the following questions, perhaps you can do it on your own:

- Can you properly diversify your portfolio?

- Are you able to avoid emotional errors on your own?

- Will you methodically rebalance your portfolio as it becomes misaligned?

- Do you know how to proactively harvest losses for tax efficiency? (read more here)

- Are you aware of financial planning and tax laws?

- Do you have the skills and analytical tools to properly assess your portfolio?

- Assuming you answered yes to all the above, do you want to spend your time doing this?

If you answered “no” to any of the above questions, don’t feel alone. Managing one’s own money will always involve some emotions, but the best investment strategy is a simple, repeatable, and disciplined process that will assist in overcoming emotional errors. Many asset managers outsource the management of their own money for that very reason.

The cornerstones of North Point’s investment process include two rules to not only eliminate but also take advantage of these common fear and greed-based errors. First, monitoring relative valuations among the asset classes prevents us from chasing overly popular stocks, and second, rebalancing forces us to buy equities when the market is down and to sell when it is up.

If you choose to hire an asset manager, make sure you understand the high-level plan and that they’re taking the time to explain what you can expect. Finally, let the process work. Short-term emotions should not trump your long-term plans.

Compliance Notes: The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. All investing involves risk including loss of principal. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss.